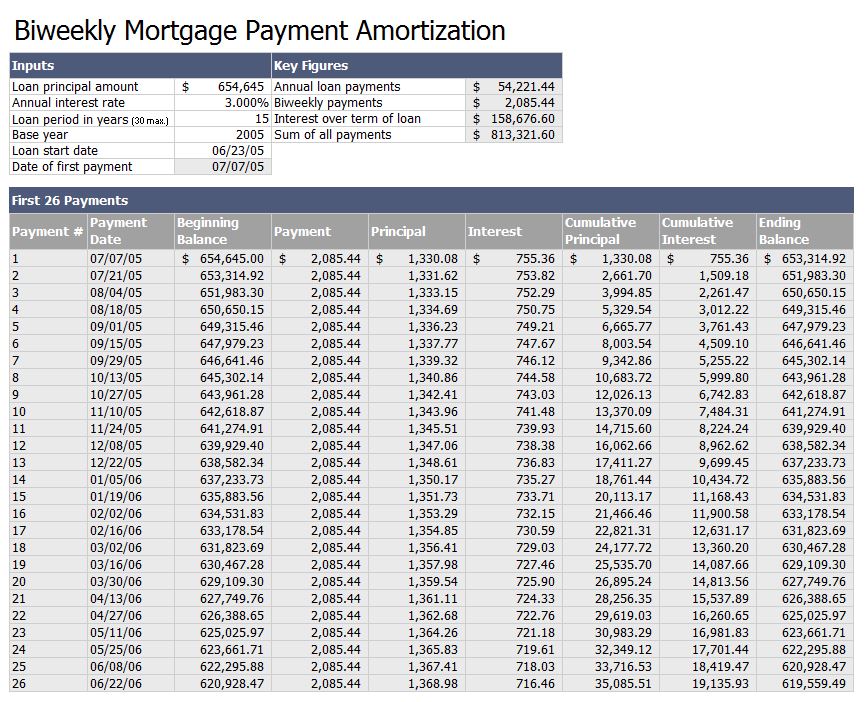

You can generate a printable table like this for you loan by clicking on the button in the above calculator after entering your loan detals. Loan Calculators - Calculate the payment amount, interest rate, length of loan, or the principal amount of the loan and get an amortization. The following table shows the principal & interest payments for the above loan. Ideally, this figure of $2,363.53 will not exceed more than 28% of your regular monthly income, or else you may need compensating factors to qualify for the loan, or you may be a candidate for a refinanced loan with smaller monthly payments over a longer period of time. Principal and interest alone makes up the vast majority – $1,951.04 – of this number, while the remaining taxes and insurance add on an additional $412.50 to the monthly bill. Keep in mind, your monthly mortgage payment may also include property taxes and home insurance - which aren't included in this amortization schedule, since the payments may fluctuate throughout your loan term. You can view amortization by month or year. At an annual interest rate of 4.8% and an annual property tax of $2,500, with two related private mortgage and homeowner's insurance payments at $104.17 and $100 per month, respectively, the total monthly payment due the consumer would be $2,363.53. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. Click on 'Generate Schedule' button to generate an amortized table for your. Choose your mortgage interest rate in 'Interest Rate' field. Insert how much is the down payment in USD or in percent in 'Down Payment' field. Take, for example, a fifteen year mortgage term wherein the borrower was taking out $250,000 from the lender. Our mortgage calculator is very easy and simple to use, heres the steps: Insert your home price in 'Home Price' field. For the sake of accounting and budgeting, you will want to consider the total of these two numbers as the amount of your income that you will actually be slicing out for your mortgage payment every month. This grand total figure itself will be divided up into two sums: the lesser one is your taxes and insurance, while the larger one is the principal and interest on its own. In this calculator, you will plug in the figures relevant to your loan scenario, including total owed, APR, term, taxes and insurance, and receive a number representing your monthly expected payment. The introductory rate is 3. To eliminate private mortgage insurance, you made a 20 down payment worth 64,000.

When your loan goes through the process of amortization, it affects both the principal and the interest aspects of the borrowed figure as each month the total drops closer towards the end goal of zero when the loan is considered terminated. Let’s presume your house is valued at 320,000 and you took a 5/1 ARM. In the context of real estate mortgages, amortization (literally from the Greek “to die off or die down”) means the graduated lowering of the principal payment of the amount owed as the borrower makes principal and interest (P & I) payments, thereby reducing or “killing off” the total sum of the loan.

Amortization is a simply a verbose way of referring to the process of a loan's decrease over its lifetime.

0 kommentar(er)

0 kommentar(er)